In the rapidly evolving world of digital finance, Peer-to-Peer (P2P) cryptocurrency exchanges have carved out a vital niche, especially in regions like India where traditional banking constraints pose challenges to direct crypto trading.

This guide delves into the essentials of P2P exchanges, emphasising their operational mechanisms, benefits, and why they are particularly advantageous in the Indian market.

Understanding P2P Crypto Exchange Platforms

What are P2P Crypto Exchanges?

P2P crypto exchanges are platforms that enable individuals to buy and sell cryptocurrencies directly with each other without the mediation of a third party. These platforms use an escrow system to secure trades, ensuring both parties fulfil their transactional promises before releasing funds. From their inception, P2P platforms have grown in sophistication, offering enhanced security features, user-friendly interfaces, and broader cryptocurrency support. This evolution is driven by technological advancements and a growing user base seeking alternatives to traditional financial systems.

How Do P2P Crypto Exchange Platforms Operate?

These exchanges provide a marketplace where buyers and sellers can post their offers, detailing the cryptocurrencies and payment methods they accept. When a user accepts an offer, the cryptocurrency is held in escrow by the platform, which releases the crypto only after the seller confirms receipt of the payment.

Here’s a streamlined overview of their operation:

- User Registration and Verification: Users sign up and verify their identity to meet Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, enhancing platform security.

- Posting and Browsing Offers: Users list buy or sell offers, specifying the cryptocurrency, amount, price, and accepted payment methods. Others browse these offers to find matches that meet their trading needs.

- Escrow Security: Upon initiating a trade, the exchange holds the cryptocurrency in escrow, securing the funds until the transaction is completed.

- Payment and Confirmation: The buyer sends the payment directly to the seller via the agreed-upon method. Once the seller confirms receipt, they instruct the exchange to release the escrowed cryptocurrency to the buyer.

- Dispute Resolution and Feedback: In case of disputes, the exchange intervenes to resolve based on provided evidence. After the trade, users can rate each other, influencing reputations within the platform.

Top 3 P2P Crypto Exchanges in India

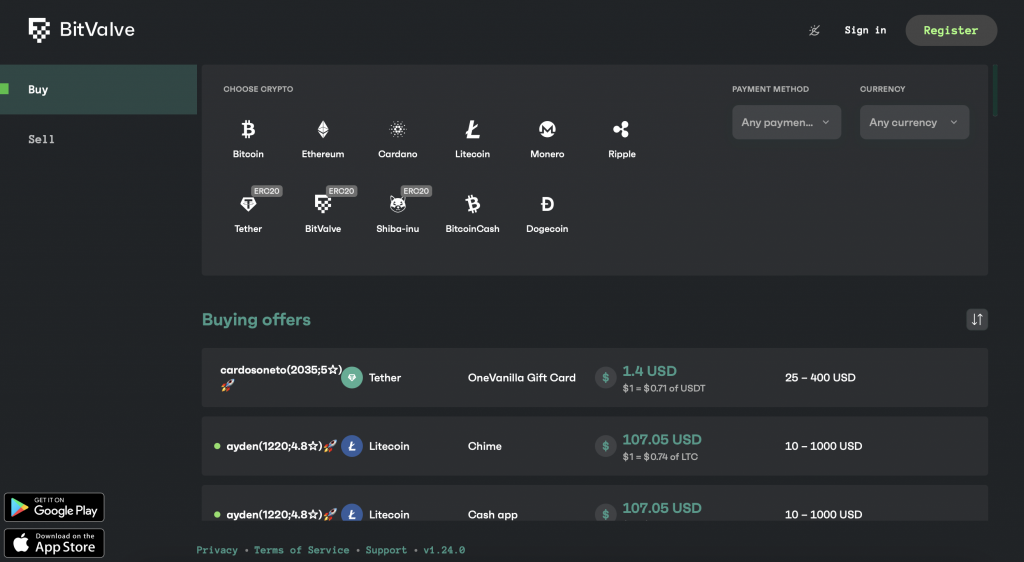

1. BitValve 🔥 🇮🇳

- Features: Advanced cross-platform support, enabling trading across various devices. Offers a wide range of cryptocurrencies such as Bitcoin, Tether, Litecoin and Monero.

- Security: Employs state-of-the-art encryption and two-factor authentication.

- User Experience: Intuitive interface designed for both novice and experienced traders.

- Pros: Lowest fees In the industry and robust technology infrastructure.

- Cons: Still expanding its user network.

- Payment Methods: Extensive options including UPI transfer, IMPS bank transfer, and digital wallets.

2. Paxful

- Features: User-centric design with strong community support and an integrated wallet for easy access to funds.

- Security: High-level security with escrow protection ensuring safe transactions.

- User Experience: Attentive customer support and a user-friendly mobile application.

- Pros: Reliability and attentive customer service.

- Cons: Higher fees compared to some other platforms.

- Payment Methods: Includes everything from credit cards to electronic fund transfers.

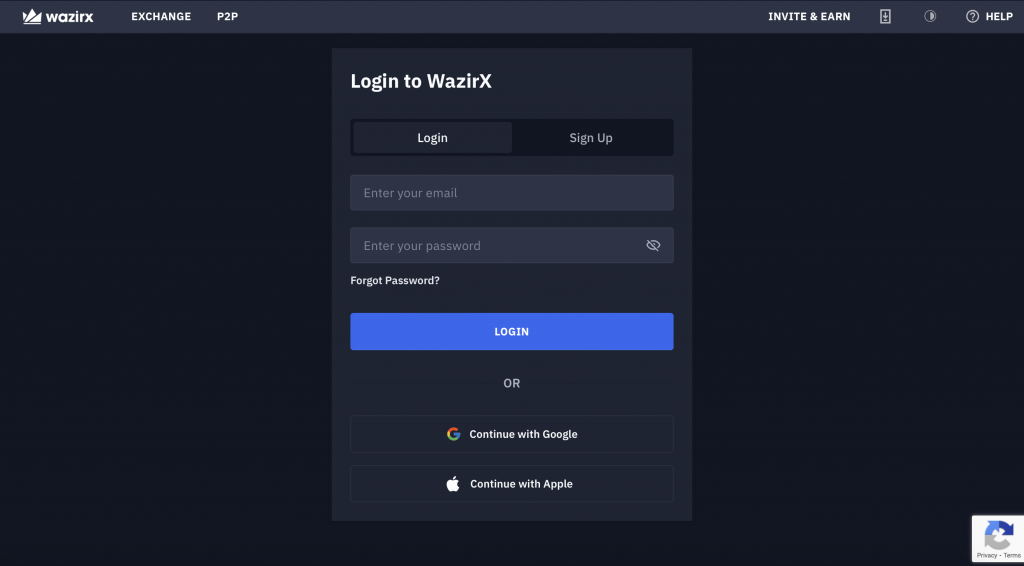

3. WazirX

- Features: One of the largest user bases in India.

- Security: Regular security audits and compliance with Indian cryptocurrency regulations.

- User Experience: Fast and reliable trading with an easy-to-use platform interface.

- Pros: Excellent liquidity and trusted by a large number of Indian traders.

- Cons: Experiences slowdowns during peak trading times.

- Payment Methods: Wide range including of online wallets and traditional banking.

Choosing the Right P2P Crypto Exchange

When selecting a P2P crypto exchange, factors to consider include security measures, user feedback, platform liquidity, fee structure, and supported cryptocurrencies. Additionally, the ease of transaction and speed of dispute resolution are crucial for a positive trading experience. Here are some key factors to keep in mind on your cryptocurrency journey:

1. Prioritize Security

Ensure the P2P crypto exchange you select employs robust security measures. Key features to look for include two-factor authentication (2FA), end-to-end encryption, and secure wallet options. These measures protect your digital assets from unauthorized access and cyber threats, ensuring a safer trading environment.

2. Check User Feedback

Investigate the platform’s reputation by exploring user reviews and feedback across forums, social media, and crypto review sites. Positive experiences shared by other users, especially from India, can signal a reliable and user-friendly platform.

3. Assess Platform Liquidity

Choose an exchange with high liquidity to facilitate quick transactions at stable prices. High liquidity indicates a high volume of trading activity, which can lead to more efficient trades without significant price fluctuations.

4. Understand Fee Structures

Compare the fee structures of different P2P exchanges. Look for clear information about fees related to buying, selling, depositing, and withdrawing assets. Opt for an exchange that offers competitive fees to optimize your trading costs.

5. Explore Supported Cryptocurrencies

A broader selection of supported cryptocurrencies allows more flexibility in your trading choices. Whether you’re interested in popular options like Bitcoin and Ethereum or lesser-known altcoins, the right exchange should cater to your needs.

6. Evaluate Ease of Transaction

A user-friendly interface is essential for a positive trading experience, especially for beginners. Platforms that are easy to navigate can enhance your trading activities, making it simpler to buy and sell digital assets.

7. Look for Quick Dispute Resolution

Responsive customer support and an efficient dispute resolution process are vital. Choose an exchange that is known for resolving disputes swiftly and effectively, ensuring you feel supported in every transaction.

8. Verify Regulatory Compliance

Select an exchange that complies with Indian regulations. Compliance not only secures the legality of your transactions but also adds an additional layer of trust and security.

Best P2P Crypto Exchange in India

Considering the criteria listed above, and to our opinion, BitValve.com is the Best P2P Crypto Exchange in India for 2024.

FAQs: P2P Crypto Exchanges

Here are the top 5 most searched questions about P2P crypto exchange platforms in India:

- What are the typical fees associated with P2P crypto exchanges?

Transaction fees on P2P crypto exchanges can vary. Many exchanges offer low or zero fees for buyers, with some charges potentially applied to sellers. For example, specific platforms may charge around 0.5% to 1% for sellers, depending on the transaction. - Which payment methods are most commonly accepted on P2P crypto exchanges in India?

P2P crypto exchanges in India support a wide range of payment methods. These include bank transfers, UPI, credit/debit cards, and even cash payments in some cases. This variety accommodates the diverse preferences of Indian users. Tip:Make sure to verify the BTC to INR currency conversion rate. - Can I trade multiple types of cryptocurrencies on P2P platforms, and what are the common types available?

Yes, most P2P exchanges in India allow trading of multiple cryptocurrencies. Commonly available cryptocurrencies include Bitcoin, Ethereum, USDT, and various altcoins, depending on the platform’s scope. - What are the implications of KYC regulations on P2P crypto exchanges in India?

KYC (Know Your Customer) regulations require users to verify their identity on P2P exchanges, impacting the signup process and trading limits. While some platforms require comprehensive KYC for increased trading limits and security, others may offer limited services without KYC to maintain user anonymity. - How does the liquidity of a P2P crypto exchange affect my trading experience?

Liquidity refers to the ease with which assets can be bought or sold at stable prices on an exchange. Higher liquidity means more seamless transactions with less price volatility, which is crucial for trading efficiency and profitability.

Conclusion

The landscape of P2P crypto exchanges in India is rich and varied, offering substantial opportunities for savvy traders. By leveraging platforms like BitValve, Paxful, and WazirX, traders can navigate the complexities of cryptocurrency markets with confidence and success. This guide aims to empower you with the knowledge and insights needed to make informed decisions in the burgeoning world of P2P crypto trading in India.

**Disclaimer** :

This article is for informational purposes only and not intended as financial advice. The content is not sponsored by or affiliated with any entities mentioned. Readers should seek independent financial advice before making investment decisions.